- Home

- Talenta Multi-Strategy

Talenta Multi-Strategy

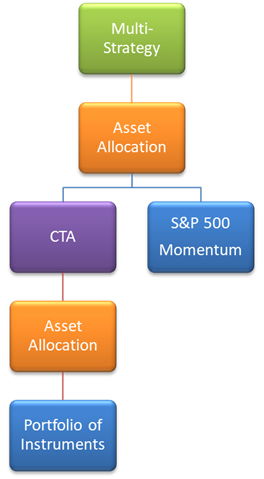

Talenta Multi-Strategy (“TMS”) aims to benefit investors who seek to capture equity market upside and protection against adverse market events (‘crisis alpha’). TMS seeks to achieve these objectives by systematically trading a diversified portfolio of highly liquid global futures with long and short positions, and by trading a momentum strategy with a long bias on S&P500 Index futures. The strategy targets an annual return of 10-15%. The approach intends to offer structural resilience in both range-bound and trending markets.

The portfolio construction uses algorithms with a low degree of freedom in parameterization. Algorithms for capital allocation, capital preservation and risk management operate across and within the portfolio and sub-strategies. Risk management techniques include: (1) volatility adjusted position sizing (2) low parameter, price-driven threshold analysis, (3) volatility ranking, (4) correlation controls, (5) limitations on equity per position, (6) portfolio heat-based risk management, and (7) risk free rate thresholds to underpin the absolute return intent.

TMS has been trading live since February 2017.

The risk of loss in commodity interest trading can be substantial.